By William Berkson:

Tax reform is not a zero-sum game. Since Ronald Reagan lowered taxes in the 1980s, followed by George W. Bush in the early 2000s and Donald Trump last year, middle class income has stagnated despite productivity increases, and overall economic growth has been mediocre. Instead of lose-lose, we can have win-win, bolstering both fairness and economic growth through sensible tax reform and wise investment of added revenues.

Fairness in taxation means finding the right balance between the taxpayer’s ability to pay and the benefits from government use of tax dollars. As I showed in a previous article government investment in education, research, and infrastructure could hugely benefit economic growth and good jobs.

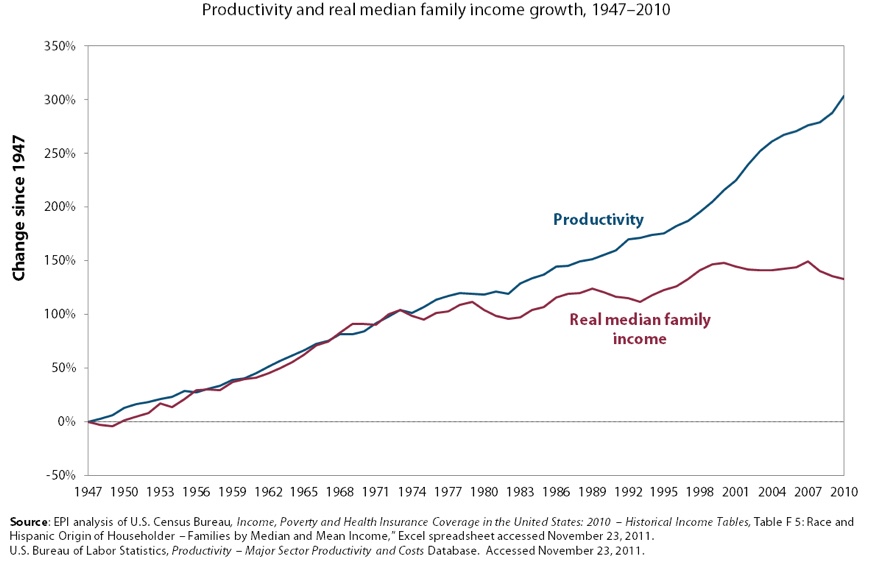

The rich are not paying their fair share today. The chart accompanying this article the Economic Policy Institute shows the growing gap between median family incomes and the value of goods and services that a worker creates. Since 1980, the additional value added by each worker has gone more and more to bosses, not employees

Eliminating the Republican-passed tax breaks for the wealthy, and publicly investing the revenues would create better paying jobs, and help close this gap.

Read the rest at The Blue View.